The year began with the inauguration of Donald Trump. I know!! It feels like he has been there for 35 years!

Quite frankly, Donald Trump has done everything in his power to crash the US stock market. Stupidly played with the tariffs globally. Antagonised allies. Played around with the largest trading partners, holding the relationship on a knife-edge. Kept flip-flopping on policies. The final straw in this stupid Olympics has been the government shutdown. It does not even seem like anyone in the US government is remotely bothered about keeping the federal government open.

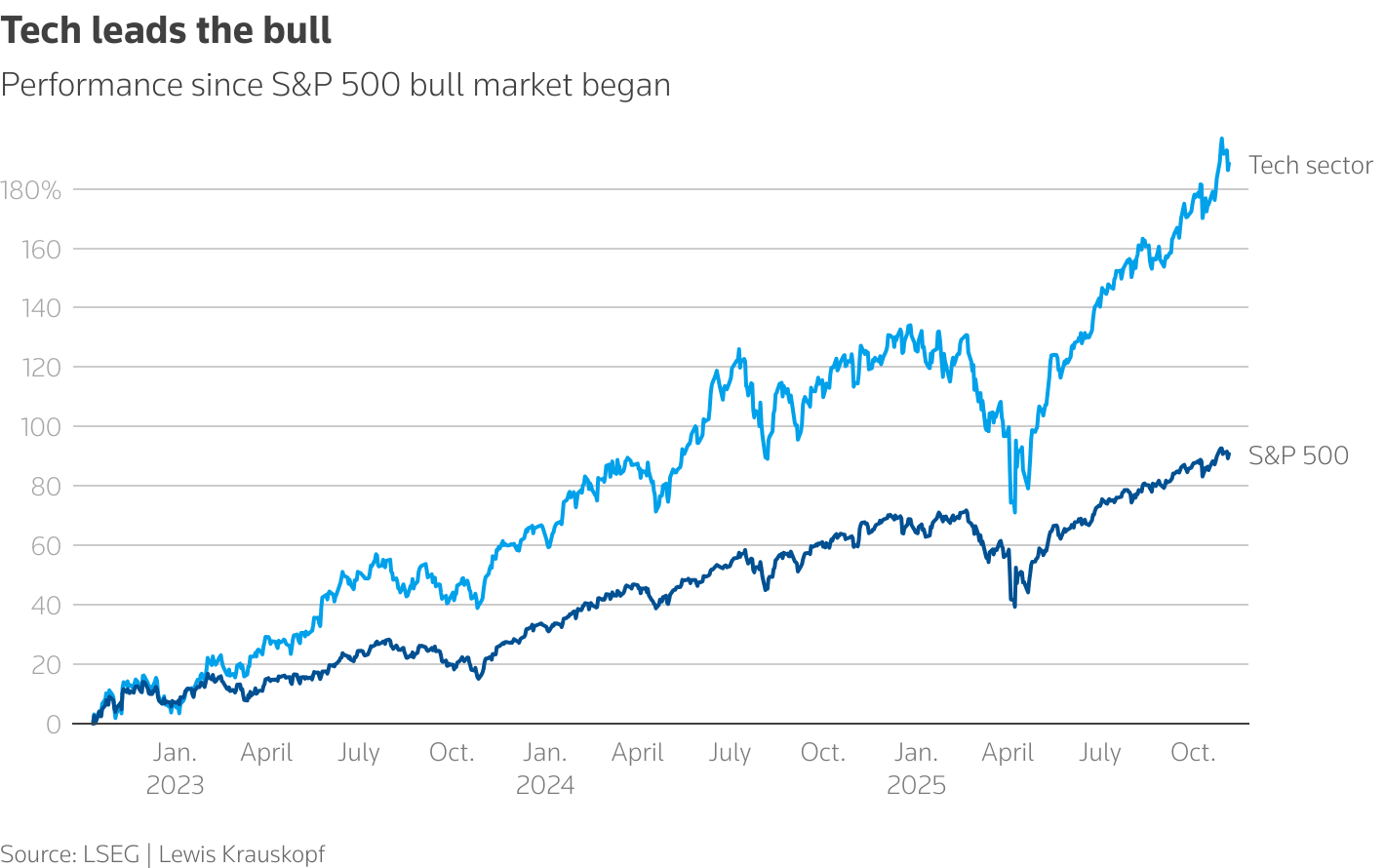

Through all of this melee, the US stock exchange has persisted. It is up nearly 10% this year. But all of that evaporates very quickly when you take the AI trades out of it.

Source: Reuters

The tech stocks with an AI narrative are up 50% and that is the bulwark that is holding up the US Stock Exchange. Except that the AI story is what investors like to call unrealised potential.

AI has yet to translate into real value on the balance sheets of various companies. There is a rush to create infrastructure and solutions that would use that infrastructure, but who will be using these solutions at scale is not really something we know.

The Price to Equity Ratio, which is a measure of how much investors expect earnings to grow, reflects this. All of the tech major, Apple, Alphabet, Microsoft, have their P/E ratios in the mid-30s. The chip manufacturers such as Nvidia and AMD are in the 70s. Data centre suppliers such as Amazon are valued in the 40s.

Just for contrast, businesses that form the backbone of the American economy, such as ExxonMobil and FedEx, are valued at a P/E ratio of 14.

The entire US stock market is a big bet on AI at the moment. If you were to remove all the tech stocks, the market would be at best flat.

If the AI story comes apart, then what?

In India, there has been a great deal of consternation about the fact that we have not been building foundational AI models. We have not innovated much in this area and are net consumers of this technology. On the flip side…

The NIFTY100 is up 9% this year.

Source: Groww

Do you know the number of companies on the Indian exchanges that are up based on their AI narrative? Zip.

The Indian markets are free of the AI contagion, and if the AI train turns out to be a wreck, India is the anti-AI trade. It has survived Trump’s trade wars. It has been consistently growing, and it is mostly fuelled by domestic consumption.

So India offers the best hedge against the American markets!

A Big sigh of relief....this AI is a contagion for sure.