Taxing the Rich | Learning by Proxy

Incredibly rich technology companies are going to have to start paying their dues

Learning by Proxy is a weekly newsletter that covers things happening around the world, along with some context that helps you understand it better. This is the 64rd edition of the newsletter.

The rich companies, especially in tech have been getting away with paying little to nothing in taxes for several years now. Those days are numbered. The rise of democrats in the US has ensured that their days of getting away with murder are over.

Escaping Tax Corporate Style

Some of the largest companies in the world pay some of the lowest taxes in the world as well. How is this even possible? You may ask.

Enter Patents.

Say I am a company that is incorporated in India which has a tax rate of 30%. Now, I create a bunch of products that involve several patents within them. I create another company in Ireland. Ireland wants technology companies to move there. They are also looking to create R&D jobs so they are willing to provide a 100% waiver on income derived through patents.

I create a company in Ireland. Sell all my patents to that company and then charge a licensing fee to the Indian company.

Because the licensing fee can be arbitrary, I charge 50% of the product cost as licensing fee to the Indian company.

After making and selling a ton of product, the Indian company ends up barely breaking even. But the Irish entity is loaded with cash. Since this income was a result of R&D, also read patents, I have a 100% per cent waiver of taxes on this income.

So although all of the business activity is actually taking place in India, all of the money is being moved to another tax residency and almost no tax accrues on it.

This is one of the variants of how tax avoidance takes place, there are, of course, several other ways to do this.

G7 or the Group of 7 countries, represent about 50% of the global GDP. This in turn means that they have a huge amount of influence on other countries and have the capability to hurt a lot of smaller economies with their sanction.

Finance leaders from the Group of 7 countries agreed to back a new global minimum tax rate of at least 15 percent that companies would have to pay regardless of where they locate their headquarters.

The agreement would also impose an additional tax on some of the largest multinational companies, potentially forcing technology giants like Amazon, Facebook and Google as well as other big global businesses to pay taxes to countries based on where their goods or services are sold, regardless of whether they have a physical presence in that nation.

Source: New York Times

Setting this floor rate for taxation makes it harder for some of the companies to change their tax residence to another country and escape taxes.

You may say, but no American company based itself out of Germany to save tax! Yes, but...

Ireland’s permissiveness has made it the biggest tax haven in the world for footloose companies, according to the economist Gabriel Zucman. Of the $616 billion in corporate profits shifted to tax havens in 2015, Zucman and his colleagues found, Ireland accounted for $106 billion.

Many manufacturers, such as Pfizer, exploit Ireland’s tax regime, but the firms that do so most prominently are in the tech sector. In 2020, for instance, Microsoft’s Irish subsidiary made $315 billion in profits, but this money was reallocated to a company resident in Bermuda, so no corporate tax had to be paid on it. Using the same clause—called the “double Irish” arrangement—Google moved $75 billion in profits out of Ireland in 2019. (The “double Irish” arrangement ended last year, under EU pressure, but other incentives work in similar ways.)

[...]

The two pillars of the G7 tax plan are designed to recover some of this avoided tax. One measure permits a country to tax any large multinational that makes profits off its residents; the company can’t claim that its profits are actually accruing to a subsidiary in another country. The second measure ensures that even if, say, a British company books its profits in Ireland and pays a 12.5% corporate tax rate there, the UK can still levy the remaining 2.5% to bring the firm’s effective tax rate to the agreed-upon 15%. With these pillars, the OECD estimates, countries can raise at least $50-80 billion a year in tax revenues.

Source: Quartz

So while the one part makes tax residency in another country irrelevant. The other part is the ability to tax the company up to 15% so long as they are generating their income from the people of said country.

While this reduces tax avoidance, it also kills two birds with one stone.

One of the greatest gripes in the EU-US relationship has been the tax avoidance of the American tech giants who have been moving their monies around the world and avoiding paying taxes in the EU. This has resulted in a complete breakdown of trust and more and more piecemeal actions that can end up breaking the internet.

Creating different laws in different countries for the internet makes it difficult to adhere to those laws for the companies. This, in fact, is also counter-productive because a company like Google which has infinite resources can potentially adhere to differing laws, the smaller startups will most certainly find it harder to scale their businesses across boundaries.

This agreement addresses that gripe.

To prevent individual countries from imposing dozens of digital taxes around the world, the agreement reached Saturday would apply a new tax to large businesses with a profit margin of at least 10 percent. The finance ministers agreed that the tax would be applied to at least 20 percent of profit exceeding that 10 percent margin “for the largest and most profitable multinational enterprises.”

[...]

“This agreement will make it possible to tax the digital giants, and for the first time to implement a minimum corporate tax rate to crack down on tax dumping,” he said on Saturday. “As talks continue, France will aim for the highest possible minimum tax rate to put an end to the race to the bottom in certain countries.”

[...]

Despite the breakthrough, completing such a sweeping agreement will not be easy and the threat of a trade war remains if countries keep their digital services taxes in place. The Biden administration said this month that it was prepared to move forward with tariffs on about $2.1 billion worth of goods from Austria, Britain, India, Italy, Spain and Turkey in retaliation for their digital taxes. However, it is keeping them on hold while the tax negotiations unfold.

Source: New York Times

Let the intimidations begin!

LIBOR No More

More than anything else, banks tend to lend a lot to one another. Depositors keep their money with banks so that they can move it at a moment's notice. In order to be able to make the transaction happen banks are required to maintain certain minimum liquidity. This also means that they have money that they cannot really use - just in case someone chooses to withdraw.

If you had a customer who is willing to buy something for 20 rupees while you can buy the same thing for 10 rupees, you would probably borrow the money, buy it and make the difference. Even after paying the interest, you should have something left to spare. Banks borrow when they see an opportunity, have the money but cannot really use it.

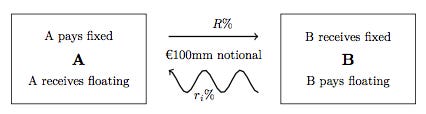

The instrument of choice is a product called the Interest Rate Swap which is essentially a contract, where the borrowing bank pays a fixed rate but has to return the money based on a floating rate usually pegged against the LIBOR.

Source: Wikipedia

The LIBOR is used as a benchmark. The LIBOR is essentially a rate published by the British Bankers' Association. This figure is based on the rates submitted by the member banks (223 of them), rates at which they claim to be able to borrow from the open market. The average the middle 50% ignoring the rest and publish a rate which is the rate at which the floating interest is fixed.

Now, if a bank raised money at 4% because LIBOR at the time was 3.9% they are expecting to lose about 0.1% on the deal. So long as the activity they carried out with that money netted them more than 0.1%, they stand to profit. But if the LIBOR was to shoot up or crash, one of the two sides would have to take the hit depending on what happens.

Although there are 223 members, the larger banks can collude to fix LIBOR at a certain rate. This is to make the markets think that they have the ability to borrow at much lower interest rates than they are actually able to. This was part of the problem that contributed to the 2008 crash.

Source: New York Times

This fixing hid the degree to which the banks were in trouble which eventually became apparent as their liquidity started to erode which ultimately led to the financial crisis.

And therefore, Libor is going to be abandoned. Or is it?

The US would love to see LIBOR gone as soon as possible. They want to replace it with another benchmark that is harder to manipulate. Treasury Secretary Janet Yellen has been insisting on giving up LIBOR by the end of 2021. But,

Rather than dwindling as regulators have urged, loans tied to Libor grew to around $223 trillion early this year compared with $199 trillion at the end of 2016, according to a March report from the Alternative Reference Rates Committee, a financial industry group made up of major banks, insurers and asset managers alongside the Federal Reserve Bank of New York.

The increase is one sign lenders have yet to fully embrace the Fed’s preferred replacement: the Secured Overnight Financing Rate, or SOFR. While large banks and mortgage lenders like Fannie Mae have started actively using the benchmark, some large U.S. corporations and other borrowers held off, seeking a benchmark that could fix rates over longer time spans.

Source: WSJ

What is this replacement by the way?

Secured Overnight Financing Rate (SOFR) is a secured interbankovernight interest rate and reference rate established as an alternative to LIBOR, which is published in a number of currencies and underpins financial contracts all over the world. Because LIBOR is derived from banks' daily quotes of borrowing costs, banks were able to manipulate the rates through lying in the surveys. Deeming it prone to manipulation, UK regulators decided to discontinue LIBOR.

As of 2021, SOFR is seen as the likely successor of LIBOR in the US. SOFR uses actual costs of transactions in the overnight repo market, calculated by the New York Federal Reserve. With US government bonds serving as collateral in the borrowing, SOFR is calculated differently from LIBOR and is considered a less risky rate. The less risky nature of SOFR may result in lower borrowing costs for companies.

Unlike the forward-looking LIBOR (which can be calculated for 3, 6 or 12 months into the future), SOFR is calculated based on past transactions, which limits the rate's predictive value on future interest rates. In addition, SOFR is overnight, whereas LIBOR can have longer tenors.

Source: Wikipedia

For Britain, this is another blow. Brexit ensured that they fell out of favour. It has had a material impact on the assets sitting in London, with many banks choosing to move their assets to mainland Europe. LIBOR was one of the last vestiges of Imperial power. This will make London a little less important.

Superbug

I came across a headline that read - "Scientists Used CRISPR to Engineer a New ‘Superbug’ That’s Invincible to All Viruses".

My only thought, why do we have to do this to ourselves?

A team at the University of Cambridge recently did just that. In a technological tour de force, they used CRISPR to replace over 18,000 codons with synthetic amino acids that don’t exist anywhere in the natural world. The result is a bacteria that’s virtually resistant to all viral infections—because it lacks the normal protein “door handles” that viruses need to infect the cell.

But that’s just the beginning of engineering life’s superpowers. Until now, scientists have only been able to slip one designer amino acid into a living organism. The new work opens the door to hacking multiple existing codons at once, copyediting at least three synthetic amino acids at the same time. And when it’s 3 out of 20, that’s enough to fundamentally rewrite life as it exists on Earth.

Source: Singularity Hub

They went in there and changed EVERY SINGLE codon in the DNA that was not performing a specific function.

Why do something whose consequence you are not aware of?

On the other end, global warming is releasing microbes that we have not had to face for many millennia.

A microscopic animal has come back to life after slumbering in the Arctic permafrost for 24,000 years.

Bdelloid rotifers typically live in watery environments and have an incredible ability to survive. Russian scientists found the creatures in a core of frozen soil extracted from the Siberian permafrost using a drilling rig.

"Our report is the hardest proof as of today that multicellular animals could withstand tens of thousands of years in cryptobiosis, the state of almost completely arrested metabolism," said Stas Malavin, a researcher at the Soil Cryology Laboratory at the Pushchino Scientific Center for Biological Research in Russia.

Source: CNN

Maybe they are too primitive and are unable to take on human immunity or not even interested in getting into humans. But given how eco-systems work, micro-organisms reproduce fast and also spread across eco-systems quickly. It is only a matter of time we discover if they are good for us or bad.

Also

I love Pen Pencil Draw

Slow-motion gymnastics!

Before you go, I wanted to suggest checking out JoeWrote, a newsletter focusing on the intersections of politics, culture, and entertainment. I've been reading it lately, and really enjoy it. I suggest their latest piece "Self Checked Out," which looks at how economic democracy can solve the destabilization of automation.

Tumbleweed Words is a literary newsletter of contemporary prose and poetry Read Here

I have started a space on Quora as well for those who wish to ask questions pertaining to the things that I write, you can visit the same here.

Also, follow me on Twitter @viveksrn to know when the newsletter drops.

What we think, we become ~ Buddha