Loan Against Everything

When technology layers are built only to serve businesses, one wonders who will watch out for the customer.

Since the beginning of the last decade, several financial companies have begun to pervade India under the moniker of Fintech. They claimed that they would make finance more accessible and would enable deeper penetration of financial services in India.

To my knowledge, the burden of penetration is being borne by only one company, and it is called the State Bank of India.

The so-called fintech companies, in the meantime, have gone after the cream of India, penetrating the urban and peri-urban markets to saturation. Payments is an unforgiving business, and the margins are razor-thin. If you process about $1 billion in India, you would net about $10 -20 million in margins. Imagine the technology infrastructure one needs to process those kinds of volumes. That revenue would only suffice to pay for the technology one would be running.

The only means for these companies to turn profitable is through lending. A relatively high-margin business. For most lenders, the cost of recovery can be rather high and mitigating this cost can make a company valuable.

Indians do not normally borrow a lot.

It said, “At 42.9 per cent of GDP (at current market prices) in June 2024, India’s household debt is relatively low compared to other EMEs, however, it has increased over the past three years”.

According to the report, household debt stood at 42.9 per cent of GDP at current market prices in June 2024. The report underlined that the rise in household debt is primarily driven by an increase in the number of borrowers, rather than a rise in the average indebtedness per individual.

Borrowing by individuals in the household sector accounted for 91 per cent of the total household financial liabilities as of March 2024.

The data revealed that individuals primarily borrow for three main purposes, consumption which includes personal loans, credit card debt, and loans for consumer durables.

Source: Times of India

At 42.9%, the total household borrowing in India stands at about $1.7 trillion through formal channels. The per capita household debt in India is a little more than $1000. Contrast this with the US

Total household debt increased by $185 billion to hit $18.39 trillion in the second quarter, according to the latest Quarterly Report on Household Debt and Credit. Mortgage balances grew by $131 billion and totaled $12.94 trillion at the end of June. Auto loan balances also increased, rising by $13 billion to reach $1.66 trillion.

Source - New York Fed

The $18.39 trillion represents about 60% of GDP. But in absolute terms, it is 37 times that of India. This is with a population that is one-quarter that of India. The per capita household debt in the US is a little more than $38000.

Commissions are based on volumes. Of course, the fintech companies would love to turn over more money.

For lending to take place, you need to know the right candidate for the debt. Enter Unified Lending Interface (ULI).

The RBI announced the introduction of ULI last month. The platform is supposed to act as a data broker which provides account aggregators with all the information pertaining to the financial position of individuals so they can make decisions about processing loans. Ostensibly, the authorisation is consent-based, but given the number of dark designs tech companies use, they will either fool you or force you into consent.

ULI can provide access to all sorts of information, including land records.

To me, this entire platform seems like the product of intense lobbying.

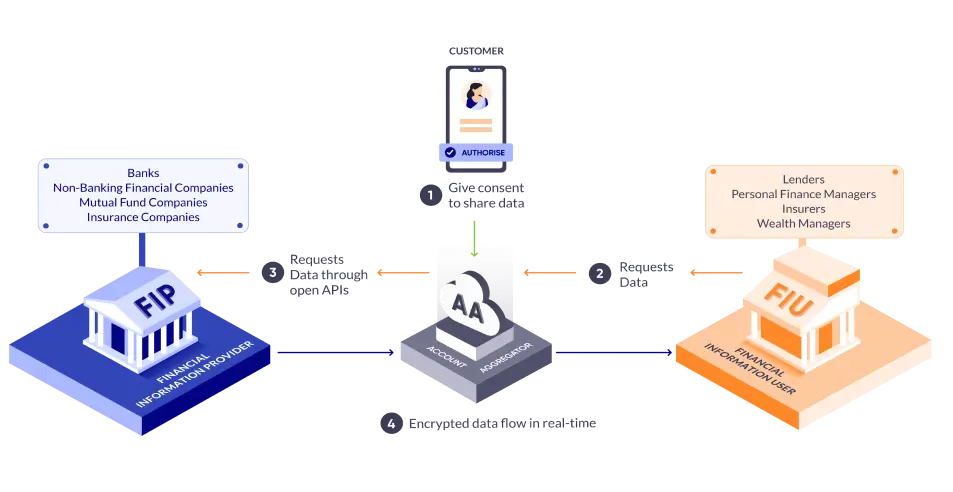

Account Aggregators (AA) are non-banking financial companies, licensed by RBI, that act like a bridge, to deliver data from Financial Information Providers (FIP) that hold your personal or corporate financial data to Financial Information Users (FIU) that are providing financial services to you.

Source: Sahamati

Most of the Account Aggregators in India are tech companies that have been built within the last 2 decades. Almost all of them have been heavily reliant on affluent consumers in urban India for their growth. It does not seem to me that this technology layer, which will be used to penetrate deeper into the population that does not possess a credit score yet. Instead, it will be put to use to mine data about the affluent lot so they can be sold more lending products.

So get ready for unsolicited loan offers against your property, fixed deposits and mutual funds.