How the USD will die

We often assume trends are obvious but often those in power do not want you to see change happening. They keep denying it till it is no longer possible to.

After the Second World War most “developed” nations apart from the USA lay in tatters. Of the countries that would go on to become the G7, Japan was perhaps in the worst condition. The country began its recovery by exporting toys to the US. Toys made with such exacting quality and standards, the likes of which did not exist anywhere. They were so well made, they are auctioned today if found in mint condition!

Msudaya 18” Battery Operated 301 racer - Source: Z&K Antiques

For decades America favoured Japanese goods to erase the guilt of bombing them twice.

Fast forward 30 years, they had overtaken Intel in the production of DRAM chips, which forced the company to abandon the memory chip business altogether and move to processors.

There are decades when nothing happens and then there are weeks when decades happen. ~ Lenin.

This quote was brandished around a great deal during the lockdown.

The essence of it is that you don’t see it coming, although it has been happening.

The Pandemic was anything but. The pandemic forced a bunch of changes in a short time. But I want to talk about changes that happen in front of our eyes and nobody sees them.

Since the world wars, the Americans have dominated the world economically. This was a result of the Neo-colonialist project that was launched after the debacle that they faced at their colony in the Philippines. Their attempts at colonisation did not play out well, you can hear all about it here.

Instead, they decided to colonise by simply placing military bases in as many countries as possible and threatening nuclear war unless they fell in line. The US has over 1000 military bases across the world. For a country whose biggest threats at the moment seem to be forest fires, hurricanes and tornadoes, that seems like a hell of a lot of military deployment.

The primacy of the US dollar is a result of coercion, not virtue.

The other reason that lent itself well to adopting the dollar was the quantum of trade that each country carried out with the US.

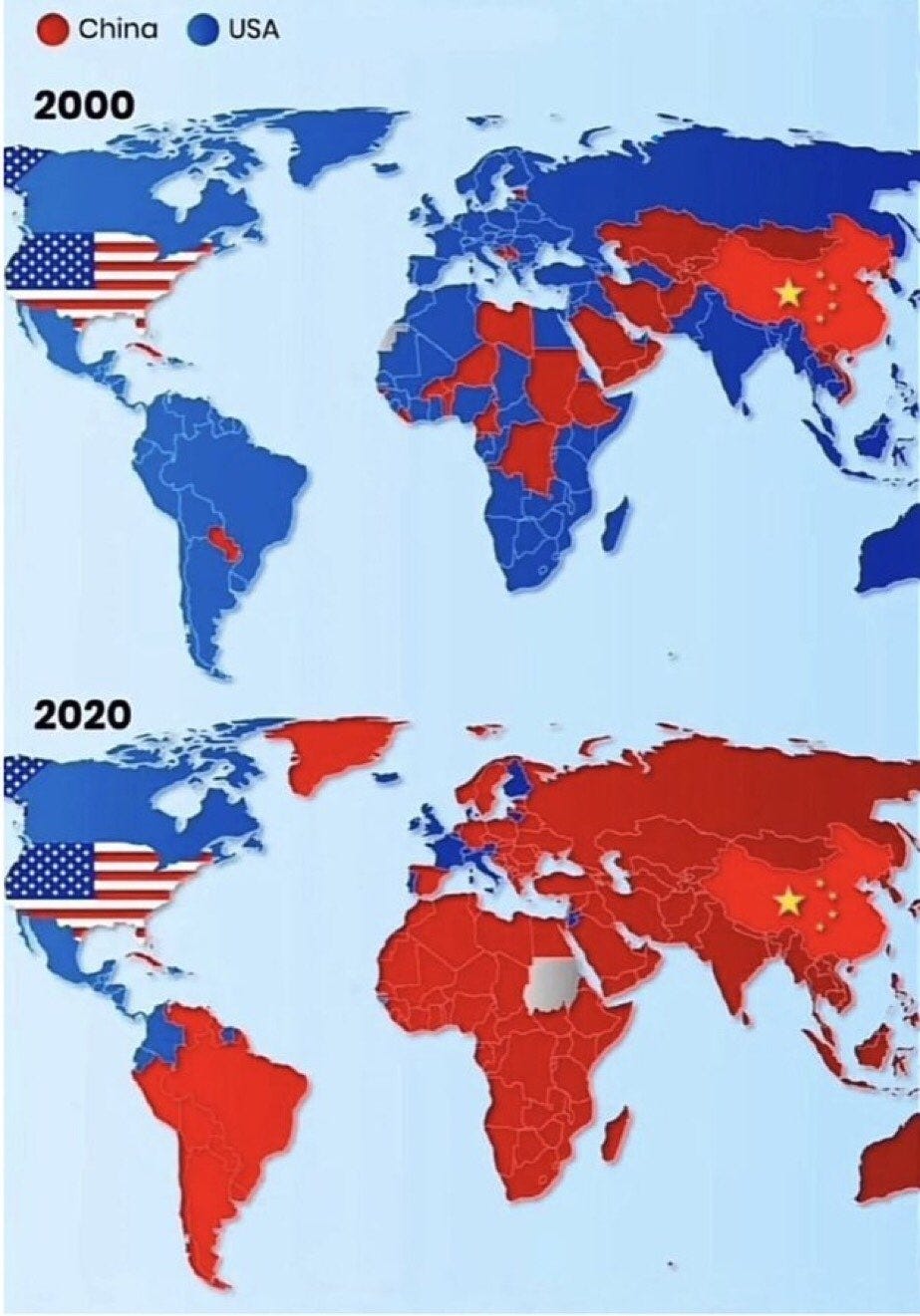

Source: MapPorn

The map above represents the country that is the largest trading partner between the USA and China. Not THE largest trading partner.

The contrast is clear.

If I am trading more with China than with the US, it makes sense for me to adopt the Chinese currency rather than the USD.

No sooner have you completed that sentence, there is a graph that you will be shown.

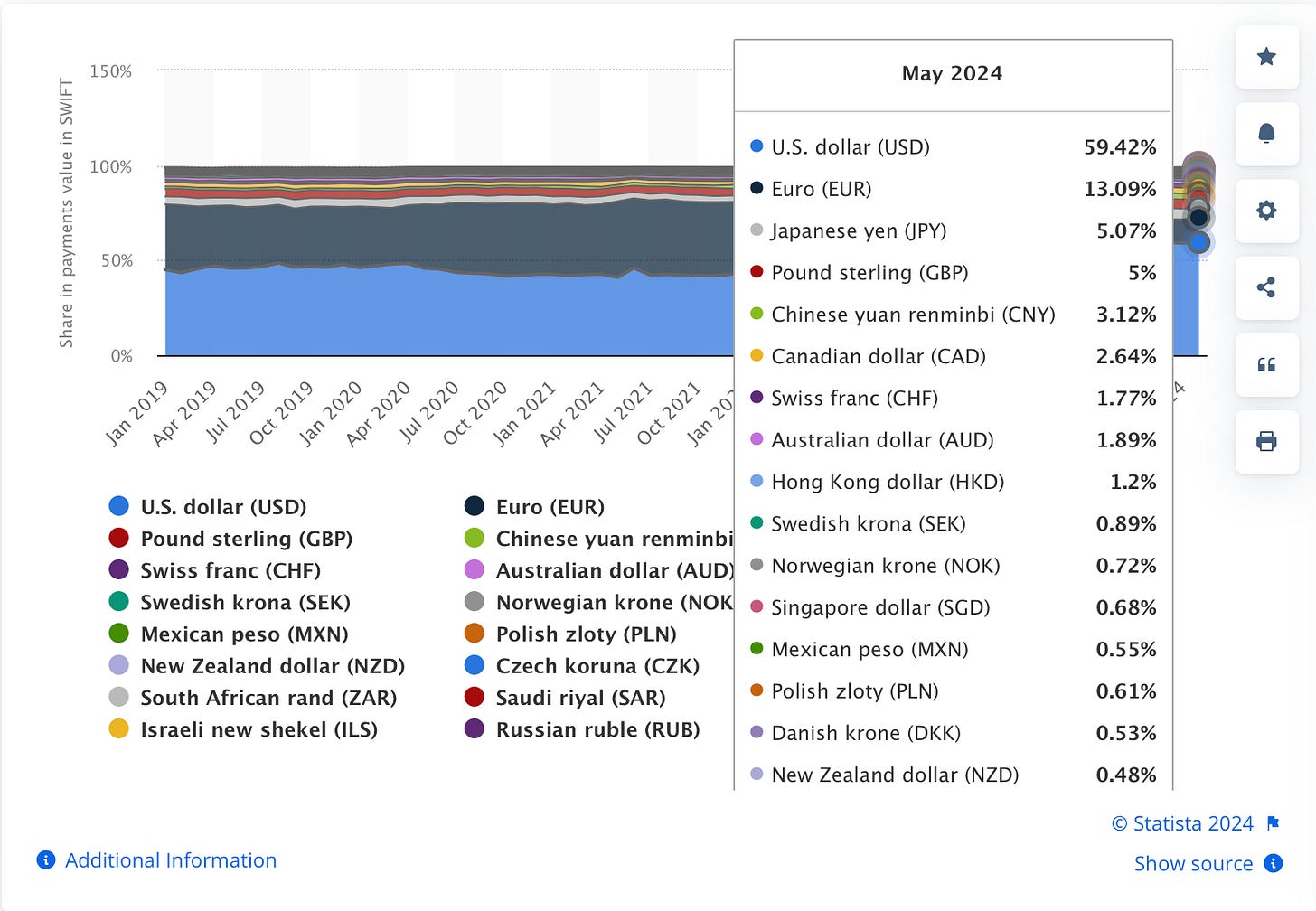

Source: Statista

This graph represents the interbank transactions taking place over SWIFT which is an international transfer protocol. As you can see the Chinese Yuan represents only 3% of the currency used for trade. But…

You see SWIFT is an “independent” organisation much like the UN or the WTO. Just like the UN was weaponised to rubber stamp the war on Iraq, recently the world watched how SWIFT was weaponised against Russia. If they can do it to Russia, they can do it to any other country. Safe to say, a whole host of alternatives have emerged.

The one thing that has to be kept in mind about technology is that it gets easier. Building an e-commerce company in 1995 took genius; today monkeys can build one.

SWIFT was high-flying tech in 1973, today, not so much.

A competing protocol is Global ACH. China itself has another protocol called the Cross-border Interbank Payment System (CIPS). It started operating in 2015.

CIPS is backed by the People's Bank of China and was launched in 2015 as part of a policy effort to internationalize the use of China’s currency.

In 2022, CIPS processed around 96.7 trillion yuan ($14.03 trillion), with about 1427 financial institutions in 109 countries and regions having connected to the system.

Source: Wikipedia

$14 Trillion is 75% of China’s GDP!

India on its part has been pushing UPI and has found partners in Singapore, UAE, Russia and France.

SWIFT processes transactions an order of magnitude higher. At $150 Trillion, it is 10 times as large. Having said that, I am not sure what the real-time data looks like because they do not seem to publish it. I would argue that it must be seeing a decline.

Going purely by SWIFT data is like standing on a beach in Miami and declaring most people who use a beach are Americans

The yuan was used in 49% of China's cross-border transactions last quarter, topping the dollar for the first time, a Nikkei analysis shows, mainly due to a more open capital market and more yuan-based trade with Russia.

Source: Nikkei

The primacy of the USD is controlled by the petro-dollar. But…

On 28 November 2023, the People’s Bank of China and the Central Bank of the United Arab Emirates renewed their currency swap agreement worth US$4.89 billion for five years. Both banks also signed a memorandum of understanding to enhance collaboration in digital currency development.

[…]

On 20 November 2023, the People’s Bank of China and the Saudi Arabian Monetary Authority signed a currency swap of US$6.98 billion for three years. In a separate development, Saudi companies were listed on the Hong Kong Stock Exchange. Saudi Arabia is in active talks with Beijing to price some of its oil sales in Chinese yuan, a move that would dent the US dollar’s dominance in the global petroleum market and mark another shift by the world’s top crude exporter towards Asia.

Source: East Asia Forum

The petro-dollar is facing a serious pushback from the biggest consumer of petrol.

The other argument for the primacy of the USD that is often cited is that people trust the country.

If you were to talk to the intelligence organisation of any country, you would know that the Americans are anything but. The country is currently engaged in the naked support of a genocide in Gaza. Their history is littered with regime changes, illegal occupations, and illegal wars.

The existence of the country in and of itself is a result of settler colonialism and ethnic cleansing at a continental scale.

Anybody who has any inkling of history would not trust the US. But still, they manage to persist how.

America’s greatest strength is not an American creation at all, but British.

English is the most spoken language across the planet thanks in large part to the Empire. This makes it possible for the American propaganda machine also known as “The Free Press” to peddle the version that the American government wishes to.

If just as many people could read Mandarin, there would be a competing narrative to be had.

Source: Wikipedia

There are a fifth as many non-native Mandarin speakers as English today. How long would it take for it to reach parity with English?

It took the Empire 300 years to get here. At the start of the 20th century, I doubt too many people outside of China spoke Chinese. Trade is one of the factors that is contributing to the change. As the Chinese trade footprint grows, the knowledge of the language grows.

For the Chinese Yuan to become the primary currency, China needs to work on making sure it spreads its language further.

This is not an economic war, but a cultural war.

But as you know, there are decades when nothing happens and then there are weeks when decades happen.