Credit Rating

A weapon that is used against countries that are often referred to as the global south

One would rarely think of credit ratings as a weapon, but it is. Three privately held companies control 95% of the credit rating business across the world - Moody's, S&P and Fitch - with the former two controlling 40% each.

These agencies rate the bonds of every country in the world. Bonds are sovereign debt and are paid for mostly through tax revenues by the government.

In a perfect world, governments would issue bonds only for development activities, since the returns produced through development would more than offset the interest paid.

Bond ratings are offered based on:

The stability of the financial system of a nation

The quality of their financial institutions

Adherence to international legal frameworks (so they can be sued on foreign soil if they refuse to pay)

They will say economic stability and a bunch of mumbo jumbo like that but it finally comes down to the stability of the tax base of the country.

If revenue = price X volume; the Income of a country = tax rate X number of payers.

Before a bank lends you money, it checks out your income stream. For most countries, taxes are its biggest income stream. It’s the basis on which the budget is built. (Tax havens make money by trading in human misery. Most of the money laundered through them is used purely for that purpose.)

Bond ratings determine how much interest a govt has to pay to raise debt. A reduction in bond ratings increases interest rates and directly takes money away from the stock market since sovereign debt is considered safer returns.

When this happens the private equity behemoths such as Blackrock, State Street and Vanguard move in and take significant positions in companies listed on the stock market. This is blatant roberry.

On the question of growth

US GDP Growth Rate

Source: Trading Economics

US Bond Yields

Source: CNBC

India GDP Growth Rate

Source: Trading Economics

Indian Bond Yields

Source: Investing.com

The Indian economic growth has outperformed the bond yield in most of the recent quarters. The reverse is true for the US. This would indicate that the Indian debt is an asset while the US debt is a liability. The debt that the US is investing provides it lower returns than the interest it pays for the debt.

Add to that, the current budget proposed in the US is “by the billionaire, for the billionaire, of the billionaire”. They are proposing tax cuts! As I mentioned already, a stable tax base is a critical cornerstone to the rating of debt. Not to mention that the current US government is eviscerating its own economy by implementing tariffs that are extremely punitive on the American people.

Indian debt is rated at BBB representing a lower or medium grade while the US debt is rated at Aa1 which is high grade.

Let us say, Greece decided to cut taxes for all of its rich and also engaged in heavy tariffs of all imports, do you think credit rating agencies would be sipping on martini and cutting their credit rating by one point.

Printing away

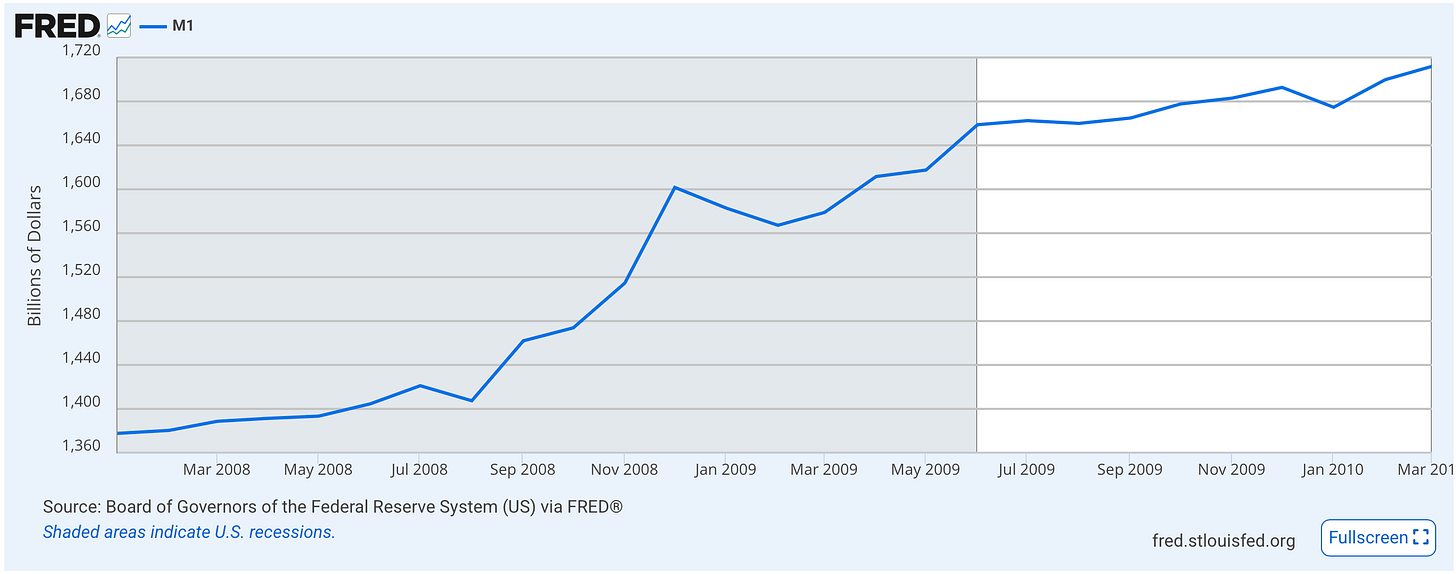

M1 is the money supply in the economy. This is the quantum of currency that the country is infusing into the economy.

The US has been printing its way out of trouble since 2008. In 2008, the US government engaged in something called the “Quantitative Easing” or printing money to pay bank executives fat salaries. The Money supply increased by almost 50%.

Source: Federal Bank of St Louis

What they did in 2020, would make this look like a blip.

Source: Federal Bank of St Louis

Hence inflation.

But without this infusion, all those billionaires with billions in paper valuations would have been reduced to nothing. This was done to protect the rich, not the poor. 16 trillion dollars in debt is enough to give every American 50,000 dollars.

USD 400 billion out of the $16 trillion went towards supporting the poor.

Forgive my segue - If America and Morals were two circles in a Venn diagram, the twine shall never meet.

The point is that this country does not represent anything akin to sound financial management in the best of times. Even then, its bond is premium grade. The entire bond rating business is rubbish and should undergo a thorough cleanup.

The crime committed in the name of bond ratings is severely destructive to the growth aspirations of nations outside of North America and Europe. It is a weapon that has been liberally used as a part of the neo-colonial project to keep countries down. The classification of countries into first-world and third-world countries is meant to indicate the interest regimes that they will be forced to operate under.

Getting a global ratings body that is divorced from any one country is more important than finding a global reserve currency other than the dollar.

This weapon needs to be dismantled, but it needs the cooperation of several people to achieve it.