AI Mania

There are different types of bubbles. The Tulip mania delivered nothing. The Railway mania left us with a lot of infrastructure.

While the term Gross Domestic Product did not exist at the time, it is estimated that during the peak years of rail construction in Britain during the 1840s, close to 10%-15% of the GDP was invested in building the railways in the country. There was a great deal of interest in investing in railways, and a lot of speculative investments were made.

The promise was free and easy goods movement. This, people assumed, would lead to more business for the railways and result in huge profits. Ores from mines and goods from factories had to be moved through canals or horse-drawn carriages before the railways. This promised to revolutionise the movement of goods and thus change the nature of business and where businesses could be set up.

Today, that investment boom is known as the British Railway Mania of the 1840s.

As the 1840s progressed, the Bank of England tightened interest rates and which burst the bubble. Shares of the railroad companies fell 50% overnight, and money left the market in a hurry.

The build-out nevertheless had a silver lining. Huge infrastructure was created, which would go on to be used to build out the rest of the network across the UK. It helped grow the economy and accelerate trade. The economy grew, but the beneficiaries were not the railroad companies; they were the businesses that took advantage of the railroads.

A train does not have any value in and of itself. They are merely a more expensive version of their toy rail set, which my nephew plays with. It is the goods within the train that provide it a semblance of value.

Large Language Models are expensive, power-guzzling and foundational infrastructure, which in and of themselves are playthings for the curious. They cannot solve any problem. It is the agents that get built on top of the foundation, which will provide them a semblance of value.

Railway companies became especially forceful promoters. They marketed shares as nearly risk-free and lured buyers with easy terms. Many offers required only a 10 percent deposit while reserving the right to call the remaining 90 percent at any time (Camplin, 2010). Enthusiasm for growth echoed the early stages of the 1990s tech boom.

Government oversight was minimal. Companies needed a Bill to pass Parliament to authorize new lines, but there were no limits on how many companies could form, and virtually anyone could submit a scheme. Financial viability was not required for approval, and many MPs held railway shares, a clear conflict of interest (The Science Museum, 2004).

Source: The Bubble Bubble

You can take the second paragraph and reword it in the context of AI. Very little rewording would be required.

Something similar is going on with the companies building foundational models. They have an incentive to say that they are carrying the arm of god.

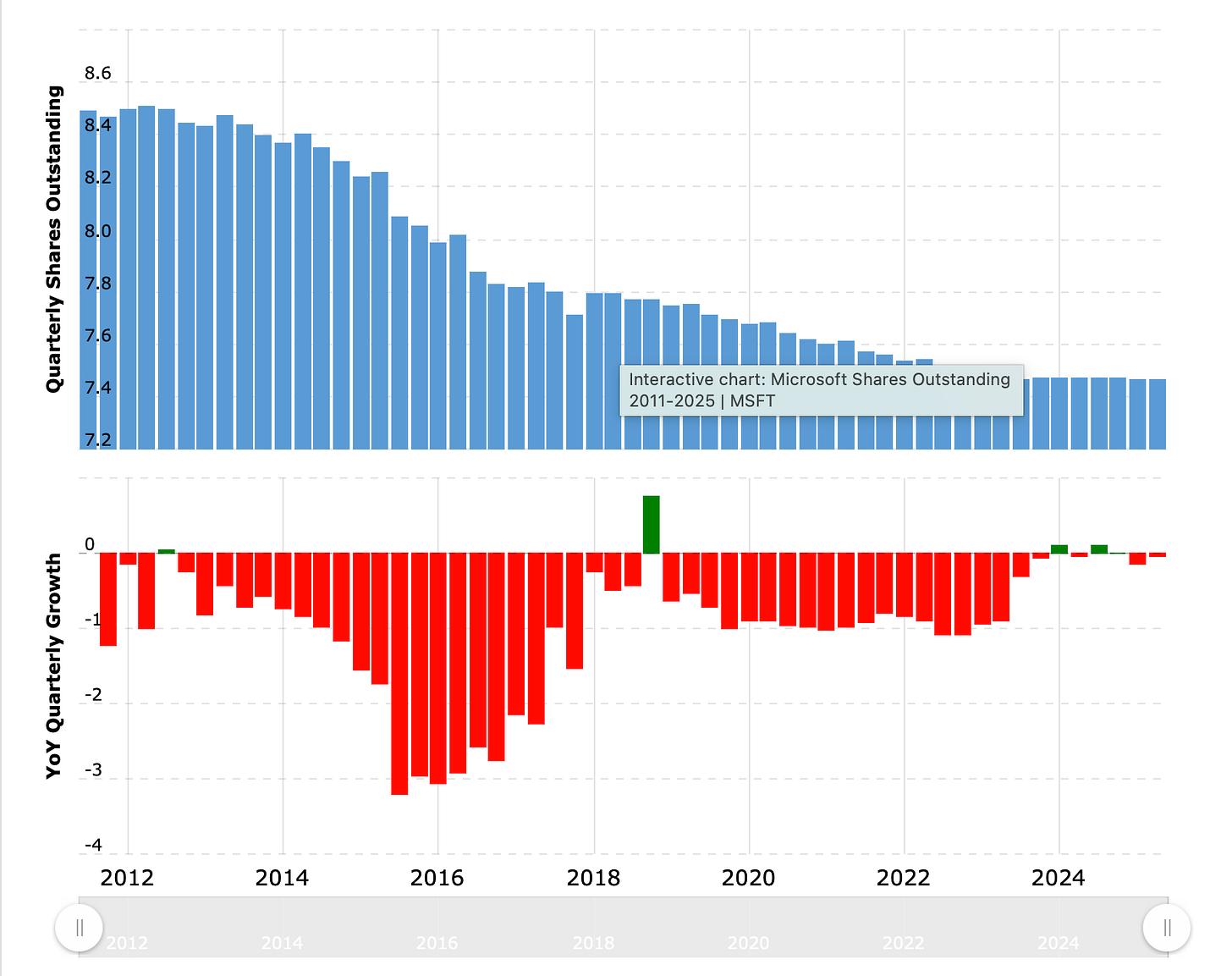

Since 2012, large tech corporations in America have been sitting on cash piles with nothing better to do than buy back shares.

Microsoft has already spent over $100 billion on share buybacks since 2015, and recently announced another $60 billion

Microsoft Shares Outstanding 2011 - 2025

Source: Macrotrends

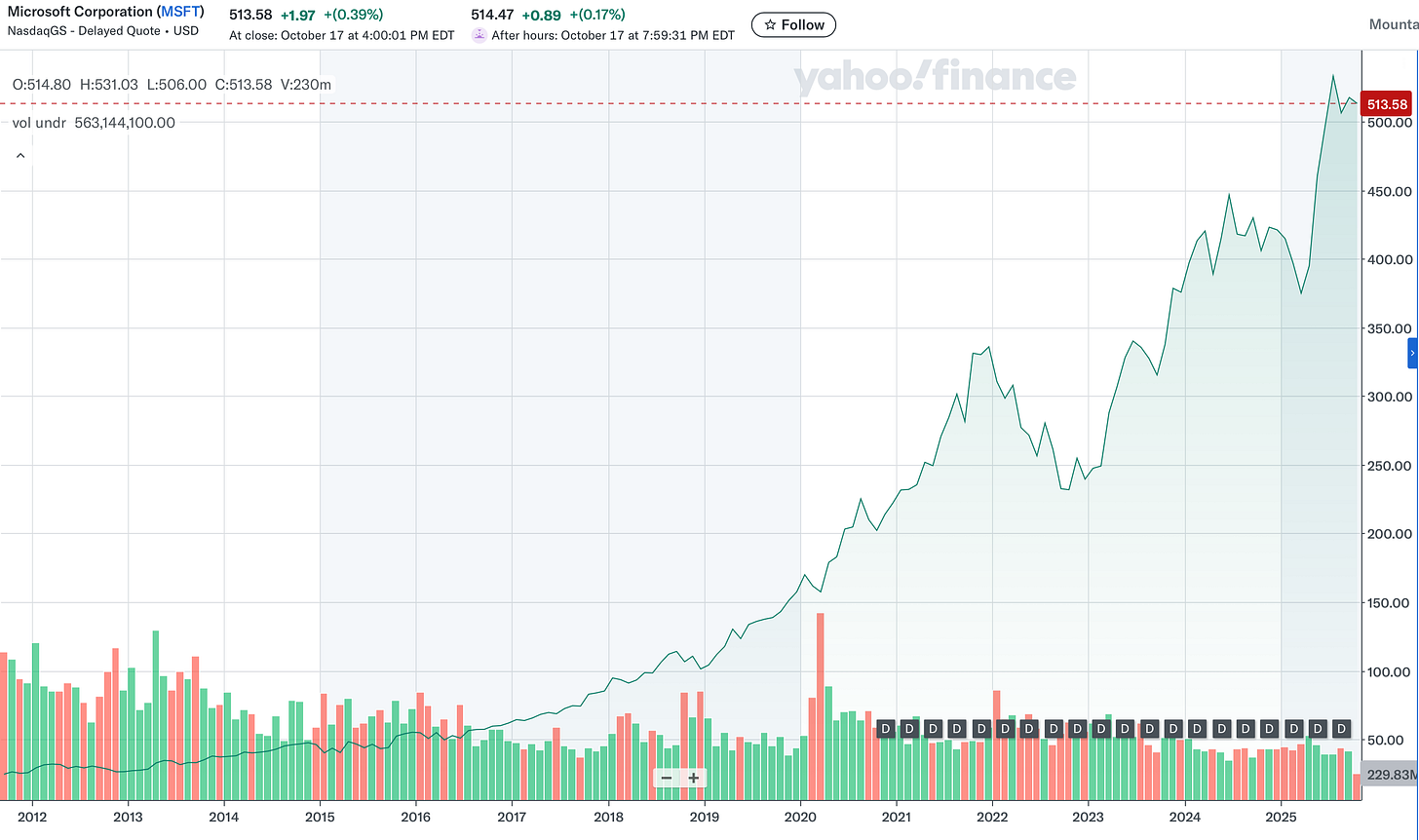

On the other hand, through the peak of the share buybacks, from 2015 - 2018, the stock price remained depressed. Then the AI story mill started to kick in, and the share prices started to rise.

Source: Yahoo Finance

I don’t want to turn this into a white paper, but you will see the same trend repeat itself with Meta, Alphabet, Apple, Oracle, and every other company that is throwing cash at Nvidia and OpenAI. Nvidia is the only company that has seen an expansion in its share base during this time. We cannot find data for OpenAI since it is still privately held, but rest assured, it is undergoing a monumental expansion of its share base.

The foundational models have value, but only so far as enabling the agent ecosystem. This bubble will burst, and much like most bubbles, it is never possible to know when it will happen. If I did, I would short Nvidia shares at the right time.

We will come out the other side, and much like the railway mania, there will be a lot of infrastructure that we will walk away with. In the meantime, there are several agentic opportunities sitting there to be exploited. The only catch is that you have to be willing to play the long game.

I wonder why manias are not called as such when they are playing out.